Cyprus Real Estate 2026: 5 Trends Every Foreign Investor Must Know Before Buying

Cyprus sits in a rare sweet spot: EU membership, a familiar legal framework for many international buyers, and a market small enough for local factors to matter. In 2026, the headlines still talk about demand, yet selection is what counts. Price growth has cooled, rules around rentals are clearer, and buyers are looking harder at energy bills and title deeds. If you are weighing up Cyprus real estates, these are the trends shaping outcomes.

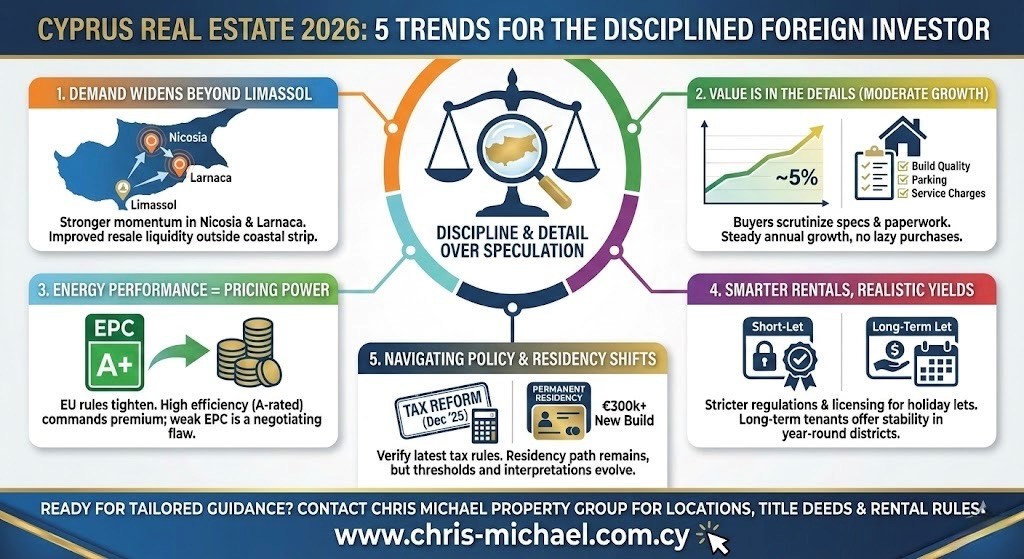

1) Foreign demand is spreading across districts, not just Limassol

Limassol remains the prestige market, but recent market reports points to stronger momentum in other districts, including Nicosia and Larnaca. The Department of Lands and Surveys publishes monthly statistics on transfers and contracts involving EU and non EU buyers by district.

This widening demand has two effects. Resale liquidity is improving outside the usual coastal strip, and well priced homes in smaller cities no longer linger.

2) Mid single digit growth is back, so value is in the details

The official House Price Index shows modest quarter to quarter movement in 2025, with steady annual increases. The Central Bank’s Residential Property Price Index also reported annual growth around 5% in 2025.

2026 is less forgiving of lazy purchases. Specification and paperwork drive the spread between properties, and buyers are paying closer attention to service charges, parking, and build quality.

3) Energy performance is turning into a pricing line

Cyprus requires an Energy Performance Certificate for properties that are sold or rented. EU rules on building energy performance are tightening, with a clear direction towards higher standards and less support for fossil fuel systems.

A weak EPC is starting to show up as a negotiating point, particularly for rentals where tenants watch utility costs.

4) Short term lets are more regulated, and yields need a reality check

Holiday rentals remain a core part of the Cyprus pitch, but compliance is no longer optional.

If your plan relies on short lets, allow for licensing steps, insurance, and professional management. Some investors are choosing long term tenants instead, especially in districts with year round employment.

5) Policy shifts and tighter checks are affecting how buyers structure deals

A substantial tax reform package was voted by Parliament in December 2025 and published in the Government Gazette on 31 December 2025. Changes can ripple into rental income planning, company structures, and succession.

Residency linked purchases also remain on the radar. A new residential purchase of minimum €300,000 paves the way for permanent residency, alongside income conditions. Because thresholds and interpretations can move, verify the latest position before paying a reservation.

A practical takeaway

Buying real estate in Cyprus in 2026 rewards discipline: pick locations with year round demand, treat energy performance as part of the price, and assume checks will be thorough. The island can still offer attractive rental returns and lifestyle upside, but only when the boring work gets done first.

If you’d like tailored guidance on locations, title deeds, and rental rules, contact Chris Michael Property Group to discuss your plans and arrange viewings.

Also Read: How Foreign Buyers Are Driving Demand for Limassol Apartments for Sale

Frequently Asked Questions:

1. How do you buy property in Cyprus as a foreigner in 2026?

Use an independent lawyer, check the seller’s title, and lodge the sale contract with the Land Registry. Confirm planning permits for new builds. Refer to the district data on foreign buyer contracts and transfers, published by The Department of Lands and Surveys, to gauge demand.

2. What are the common purchase costs and taxes for Cyprus real estate?

Budget for legal fees, stamp duty on the contract, Land Registry transfer fees, and municipal charges, including communal service charges. New property can attract VAT at 19%, with reduced rates in defined cases, so ask your adviser to run the numbers early and in writing.

3. Is the Cyprus permanent residence by investment route still based on buying a new home?

Many guides describe a requirement to buy a new residential property worth at least €300,000 plus VAT, with proof of overseas income. Treat that as a headline. Rules and interpretations can change, so confirm the latest position through official sources and a regulated immigration professional.

4. Can you run an Airbnb style short let legally in Cyprus in 2026?

Yes, but you may need to register as a self service accommodation provider and meet safety and operational conditions. Remember that build compliance and management costs into your yield forecast rather than assuming constant occupancy.

5. What should you check before reserving a new build apartment in Cyprus?

Confirm land ownership, existing mortgages, delivery timelines, and when title deeds are expected. Ask for the Energy Performance Certificate or projected rating, because EPCs are required on sales and rentals. A surveyor can spot shortcuts. This reduces the risk of buying Cyprus properties that disappoint after handover.