The Hidden Costs of Buying Property in Cyprus (And How to Budget for Them)

Buying a home in Cyprus can feel refreshingly straightforward: you agree a price, put down a deposit, and plan the move. The surprise usually comes later, when the “extras” start appearing in emails from lawyers, banks, developers and local authorities. None of these costs are mysterious in themselves, but they add up quickly and they don’t always arrive on the same timetable as the purchase price.

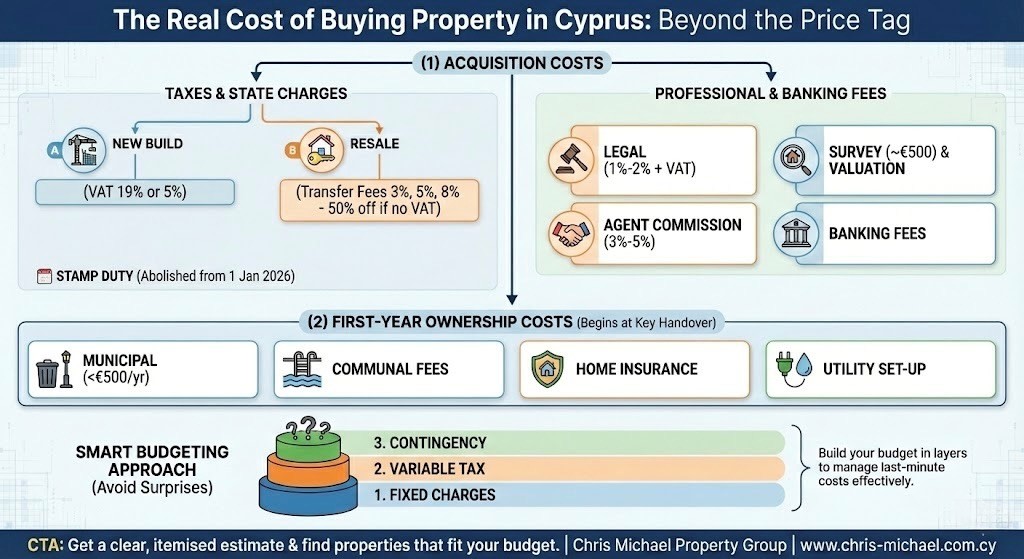

If you’re looking at Limassol properties or any other part of the island, a sensible budget starts with a clear split between (1) one-off acquisition costs and (2) the first-year ownership costs that begin the moment keys change hands.

1. Taxes and state charges that vary by property type

The largest swing factor is whether the property is new and subject to VAT, or a resale where transfer fees apply instead.

- VAT on new builds. The standard VAT rate is 19% for most new property transactions, but a reduced 5% rate may apply for an eligible primary and permanent residence under specific size and value rules. PwC sets the reduced rate around the first 130 square metres up to a capped value, with ceilings on total area and total transaction value.

This is not a box-ticking exercise. If you assume 5% VAT and later discover you don’t qualify, the budget gap can be painful.

- Transfer fees on resales. Where VAT is not charged, the buyer typically faces Land Registry transfer fees on a progressive scale (commonly discussed as 3%, 5% and 8% bands). Under current rules, transfer fees are not payable if VAT applied, and they are generally reduced by 50% when the purchase is not subject to VAT.

Transfer fees are calculated on the market value assessed at the time of transfer, not always the exact figure you negotiated. That’s why buyers who “won a bargain” sometimes still pay fees that look like they’re based on a higher number.

- Stamp duty: A moving target around 1 January 2026. Cyprus has abolished stamp duty from 1 January 2026 for documents signed from that date, but documents signed up to 31 December 2025 can still fall under the previous framework.

For buyers with long lead times (off-plan purchases, or contracts signed months before completion), this timing point is worth raising early with your lawyer.

2) Professional fees that protect you, but still cost money

- Legal fees: Many buyers budget 1% and call it done. In practice, legal fees often land in the 1%–2% range depending on complexity, and VAT may apply to the lawyer’s services.

A cheaper conveyancing quote can become expensive if it excludes key checks (planning permissions, title status, developer mortgages, communal obligations). Ask what’s included in plain language.

- Survey and valuation: A building survey is not compulsory, but it’s one of the few costs that can prevent a much larger bill later. One guide puts the average charge for a building survey in Cyprus at around €500, with price varying by property and report type.

If you’re arranging a mortgage, the bank may also require its own valuation fee, separate from your survey.

- Agent commission: Confirm who pays. It’s common for the seller to pay the estate agent’s commission, often quoted in a 3%–5% range, but this should never be assumed.

If you’re browsing properties for sale in Cyprus Limassol, check the agency agreement or your reservation paperwork so you don’t inherit a fee you didn’t expect.

3) Banking and payment friction: the quiet drain on budgets

Even cash buyers can get caught here. International transfers, exchange-rate margins and bank processing fees are small individually, then oddly large in total. If you’re paying a developer in stages, those charges can repeat multiple times.

Mortgage borrowers should also expect arrangement fees, valuation fees, and sometimes life insurance requirements tied to the loan. The exact numbers vary by lender, so treat this category as a “get quotes early” item rather than a fixed percentage.

4) First-year ownership costs people forget to include

Cyprus abolished the national Immovable Property Tax in 2017, which helps keep annual ownership costs lower than some buyers expect.

That said, local charges don’t vanish. Municipalities can levy fees for services such as refuse collection, sewerage and street lighting, and these vary by area and property characteristics. These local charges generally do not exceed about €500 per year, though your actual bill depends on where you live.

Then there are the costs that feel “optional” until you own the place:

- Communal fees in apartment blocks or gated developments (lifts, pools, gardens, security).

- Home insurance, which is often required for mortgaged property and still wise for cash purchases.

Utility connection and set-up, particularly for new builds where accounts need opening and deposits paying.

5) A budgeting method that avoids nasty surprises

A workable approach is to build your budget in layers:

- Known fixed charges (legal quote, survey quote, and Land Registry fees where applicable).

- Big variable tax line (VAT or transfer fees, depending on the property type).

- A contingency buffer for valuation gaps, extra certificates, document handling, and utility set-up.

Many buyers set a contingency of several percentage points of the purchase price, not because Cyprus is unusually risky, but because property transactions always produce last-minute admin costs. If your purchase is tight, it’s better to know now than discover it the week before completion.

Speak with Chris Michael Property Group for a clear, itemised estimate of purchase costs and a shortlist that fits your budget before you commit.

Also Read: Investing in Limassol Real Estate: Key Trends and Opportunities 2026

Frequently Asked Questions:

1) What are the typical closing costs when buying a resale home in Cyprus?

For resale property purchases, buyers often pay transfer fees (usually reduced where VAT isn’t charged), legal fees, and smaller administrative costs. Transfer fees are progressive and depend on the Land Registry’s assessed value, not always the agreed price. Add a survey if you want independent reassurance on condition.

2) Do I pay VAT or transfer fees when buying a new build in Cyprus?

Generally, a new build falls under VAT, and transfer fees are not payable when VAT applies. Eligibility for the reduced 5% VAT rate depends on specific rules about primary residence use, size and value thresholds, so confirm this before you commit to a price.

3) Is stamp duty still payable on property purchase contracts in 2026?

Stamp duty has been abolished from 1 January 2026 for documents signed from that date. Contracts signed up to 31 December 2025 may still be subject to the earlier rules, which matters for off-plan purchases and long completion timelines.

4) What ongoing costs should I budget for after buying an apartment in Limassol?

Plan for municipal charges (refuse, sewerage and local services) plus communal fees if the building has shared facilities. Cyprus no longer levies national immovable property tax, but local bills still arrive annually and can vary by municipality and property.

5) If I want to buy property in Limassol, what is a sensible contingency buffer?

To buy a property in Limassol, a practical buffer covers valuation differences, extra legal checks, certificate costs, and utilities set-up. Many buyers keep a contingency of several percentage points of the purchase price, scaled up if the property is complex (shared title issues, new development, or staged payments).