Apartments vs. Houses: Why Apartment Values Are Outpacing Homes in 2026

In 2026, many buyers are choosing what they can finance and run, not what they might once have stretched for. In a growing number of markets, that shift is pushing apartment values ahead of houses, particularly in and around cities.

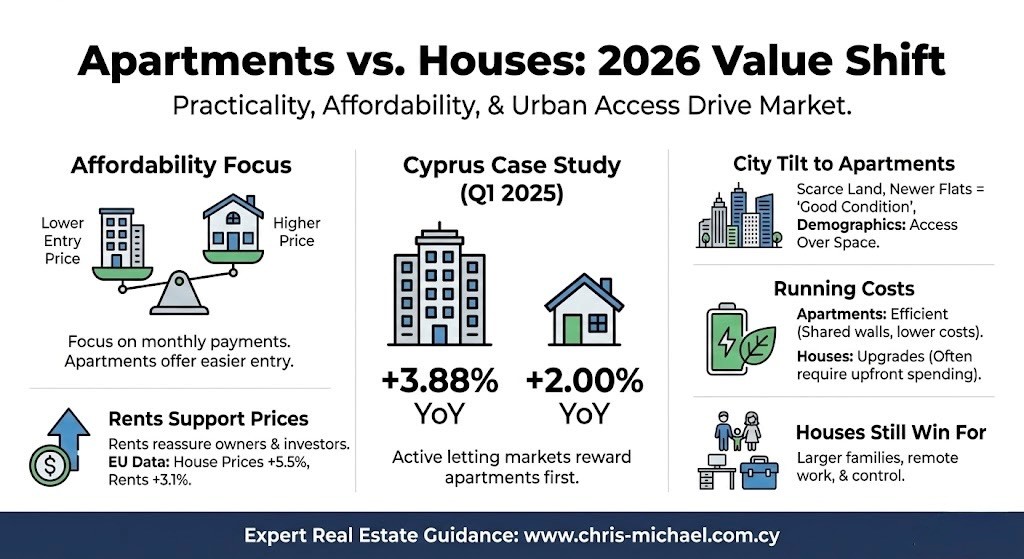

Affordability is setting the pace

Most households buy on monthly payment. An apartment’s lower entry price often means a smaller deposit and a mortgage that meets lenders’ affordability tests.

The UK offers a timely illustration of how cautious demand behaves. Zoopla has reported stronger buyer demand at the start of 2026 after a lull before the November budget, helped by cheaper fixed-rate mortgages. Demand is still below last year’s levels, so many buyers start with smaller properties and negotiate hard.

Rents keep a floor under prices

Rising rents give investors room to bid and reassure owner-occupiers that the home would let quickly if plans change.

Eurostat’s January 2026 release reported EU house prices up 5.5% year-on-year in Q3 2025 and rents up 3.1%. Both also rose compared with the previous quarter.

A clear case study: Cyprus

In Cyprus, apartments were the strongest national performer in 2025 Q1: apartments rose 3.88% year-on-year, while houses rose 2.00%.

Rental demand supports that picture. A study reported by Cyprus Mail found that standard apartment rents mostly increased across major cities between August and October 2025, while noting that some movements may be seasonal.

Seasonality aside, active letting markets tend to reward apartments first, because they are the default choice for mobile households.

Why cities tilt towards apartments

Land close to jobs is scarce, and new supply near centres usually arrives as blocks. That shapes city centre apartment prices, because newer flats often set the benchmark for what “good condition” looks like.

Apartments also match household patterns: more single-person living, later family formation, and more people prioritising access over square metres.

Running costs are now part of the price

Energy and maintenance have become valuation inputs. Many newer apartments benefit from shared walls, smaller floor areas and modern glazing. A house can be efficient too, but upgrades often require large, upfront spending that buyers price in.

Where houses still win

Houses remain the better fit for larger families, remote work setups, and buyers who want control over repairs. In some suburbs, scarcity still delivers strong house price growth. Even so, 2026 rewards practicality, and apartments often meet it first.

Also Read: Why Renting an Apartment in Limassol is a Smart Move in 2026

Frequently Asked Questions:

1) Are apartments always a better investment than houses in 2026?

No. Apartments to rent in Limassol can outperform where rental demand is strong and supply is constrained, especially near jobs and transport. Houses can be the safer bet where service charges are high, buildings are ageing, or buyers prize space.

2) What evidence suggests apartment values are rising faster in some markets?

At an EU level, Eurostat reported rising house prices and rising rents in Q3 2025, a supportive mix for rental-led segments. In Cyprus, the RICS index showed apartments up 3.88% year-on-year in 2025 Q1 versus 2.00% for houses, indicating faster apartment appreciation in that period.

3) Do service charges and building fees wipe out apartment gains?

They can. UK leaseholders have reported sharp increases and large one-off demands, which can deter buyers and lenders. Before you buy, request building accounts, reserve fund details, and planned maintenance. If answers are vague, assume the risk is real and price it in.

4) What should renters and buyers look for in Limassol apartments?

Prioritise features that protect both rent and resale: parking, storage, sound insulation, lift condition, and clear management arrangements. If you are still comparing areas, checking apartments for rent in Limassol Cyprus gives you an idea on what tenants value and what rents are achievable for similar layouts.

5) Are houses becoming poor value in 2026?

Not necessarily. Houses can outperform in school catchments, low-density suburbs, and places where land is tightly held. The current edge for apartments often comes from affordability and demand rather than a sudden dislike of houses. Ask what buyers in your area can realistically borrow, and you will usually see why the gap opens.

Browse current availability and neighbourhood pricing on our site, then book a viewing with our team if you’re weighing up apartments or flats for rent in Limassol. You’ll get straight answers on running costs, building management, and what’s realistically achievable for your budget.