Structural Oversupply: Is Limassol Building Homes No One Wants?

Limassol’s skyline has changed fast. New blocks appear, cranes linger, glossy marketing boards promise “lifestyle”, and yet plenty of people hunting for an ordinary flat will tell you the same thing: the choices don’t always match the budget, or the homes on offer don’t suit the way people actually live.

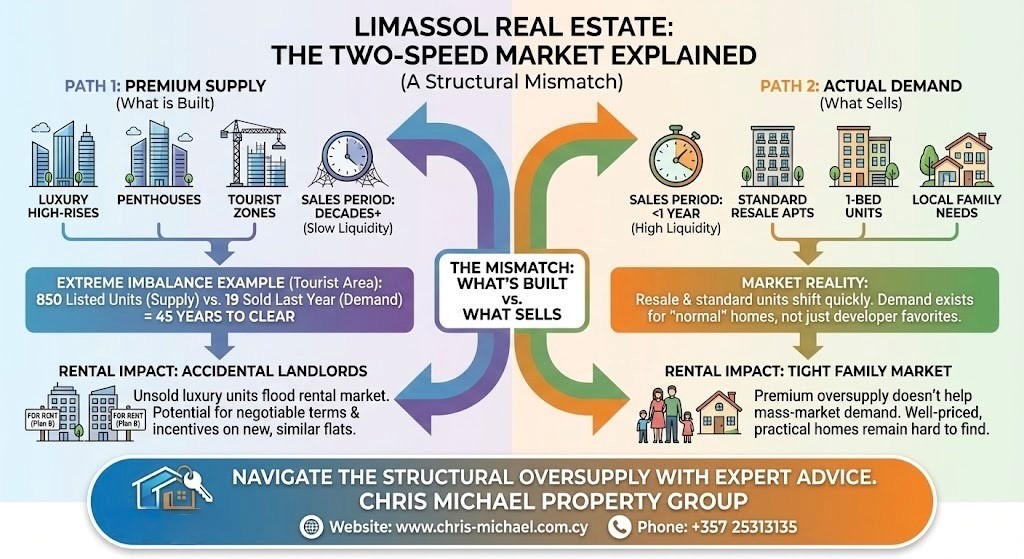

So is Limassol building homes no one wants? Not quite. A recent study by Perprice points to something more specific: a mismatch between what is being built and what sells quickly. That mismatch can ripple out into the rental market too, affecting what tenants see when they search. Here are the key findings from the Perprice study.

1) Oversupply isn’t “too many homes” in general. It’s too many in certain segments

The study looks at supply and demand by asking a simple question: if demand stays at its current level, how long would it take to sell the apartments currently listed? It calls this the “sales period” and measures it in years.

That idea matters because it highlights where the market is clogged, rather than implying the whole city is overbuilt.

2) Standard apartments on the resale market still shift quickly

The standard apartments on the secondary market show the highest liquidity, with one-bedroom units selling in less than a year on average.

This is a strong hint that demand for “normal” homes exists. People do want apartments, just not always the ones developers most like building.

3) The premium ladder gets slower at every rung

The pattern in the study is blunt: the higher the class of housing, the longer it takes to sell.

- Standard units move fastest.

- Apartments with shared pools take longer.

- Penthouses take longer again.

- Luxury apartments sit at the slow end, with sales periods stretching into decades in some cases.

That’s what structural oversupply looks like. It isn’t that Limassol has no buyers. It’s that the pool of buyers for premium stock is much smaller than the pipeline of premium stock coming to market.

4) New-build liquidity is weaker than resale liquidity

The study also finds that overall liquidity on the primary market is considerably lower than on the secondary market.

New-build supply can look impressive on paper, but if those units don’t match what the broad market can absorb, they linger. When they linger, developers and sellers have to choose between adjusting price, offering incentives, or waiting.

5) The tourist area case study shows how extreme the imbalance can get

The study includes a case example that puts numbers on a situation many locals recognise: the central tourist area, covering Neapolis, Germasogeia, and Mouttagiaka up to the highway.

In that zone, the analysis found around 850 similar apartments listed for sale (mostly under construction or completed but without title deeds), while only 19 comparable transactions were recorded over the previous year. At that pace, the supply would take around 45 years to absorb if demand stayed the same.

Simply put, when supply piles up in one location and one product type, it can distort pricing, expectations, and even the look and feel of the neighbourhood.

What this means for renters

This is where the “for sale” market quietly meets the rental market. When developers and investors struggle to sell, some units end up being rented out instead, often as a plan B. That can increase choice in certain pockets, especially for newer, higher-spec flats.

If you’re searching for apartments for rent in Limassol Cyprus, keep an eye on buildings with a lot of similar, near-identical units. Landlords in those blocks may be more willing to compete on terms: a slightly lower monthly figure, included common expenses, or flexibility on contract length. You may not see that in every listing, but it’s a common outcome when sellers become accidental landlords.

Why the rental market can still feel tight despite oversupply headlines

Here’s the catch: oversupply at the premium end doesn’t automatically create abundance for everyone else.

A family looking for a sensibly priced, well-laid-out home near schools is not necessarily helped by a surplus of glossy two-beds aimed at short-term corporate demand. The study’s own conclusion points towards rebalancing development priorities away from premium stock and towards mass-market demand.

That helps explain why tenants can scroll through plenty of listings and still struggle to find something that fits.

Few tricks to consider when choosing where to rent in Cyprus

A few grounded tactics can make searches more efficient:

- Treat “newer” as a category, not a guarantee. New buildings can vary wildly in sound insulation, parking, and ongoing communal costs.

- Compare not only price, but also how long a listing has been live. Stale listings can signal room for negotiation.

- Ask direct questions about title deeds, snagging, and management fees if you’re renting in a recently completed development. These issues affect maintenance response times and the overall experience of living there.

If you’re weighing up apartments to rent in Limassol, this approach helps you spot when a landlord is competing in a crowded segment versus when they’re offering something genuinely scarce.

Also Read: When Will Your Cyprus Property Pay Its Own Way? Mapping the Break-Even Timeline

What to watch next if you care about pricing

Structural oversupply rarely “fixes itself” overnight. Markets correct through a mix of price adjustments, product changes, and slower building starts. The study’s warning is essentially that Limassol risks leaning too hard into premium development while demand remains limited.

For tenants looking at flats for rent Limassol, that could translate into a split market: steady pressure on well-priced, practical homes, alongside increasing incentives in new-build pockets where too many similar units are chasing too few takers.

If you’re seeing “oversupply” headlines but still struggling to find a good-value home in Limassol, Chris Michael Property Group can help you cut through the noise. Spot which segments are actually negotiable, and target listings where landlords are more flexible on price and terms.

Browse available rentals and get expert, local guidance at chris-michael.com.cy, or call +357 25313135 to shortlist the right options and book viewings.